Let’s be honest. Relying on a single paycheck feels a bit like building a house on one pillar. Sure, it might hold for a while, but a strong wind—a layoff, an unexpected medical bill, a sudden economic shift—can make the whole thing feel terrifyingly wobbly.

That’s where the idea of income diversification comes in. It’s not just for the wealthy. In fact, it’s arguably more critical for the rest of us. And thanks to micro-investing platforms, building that diversified income stream is no longer a distant dream reserved for those with thousands to spare. It’s accessible, right now, from your phone.

What is Micro-Investing, Really?

Forget the old image of a stockbroker yelling on a trading floor. Micro-investing is the quiet, digital cousin. It’s the practice of investing small, often “spare” amounts of money—the digital change from your coffee run, a few dollars from a side hustle, whatever you can consistently set aside.

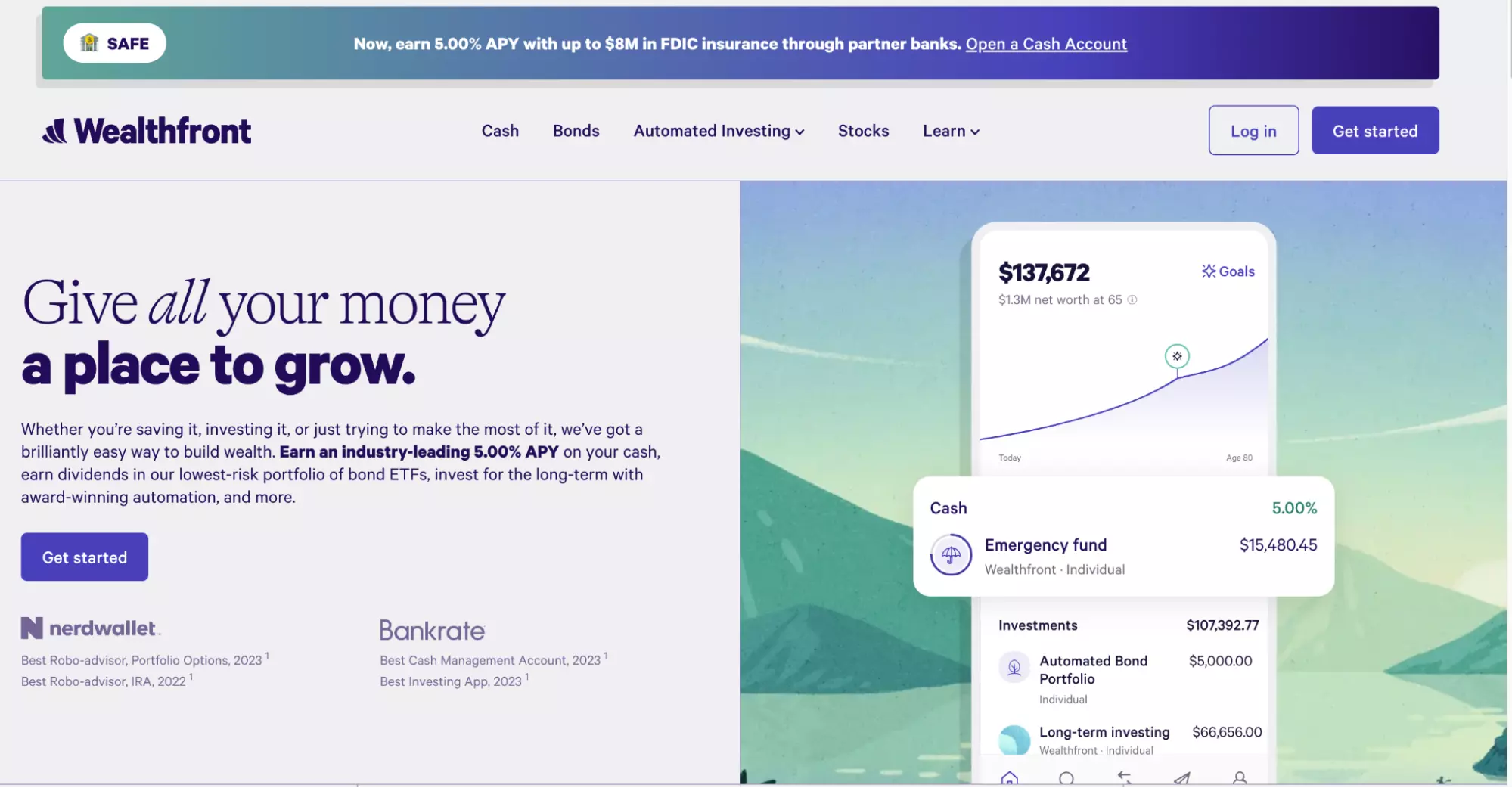

These platforms, like Acorns, Stash, or Public, have demolished the traditional barriers. High account minimums? Gone. Hefty commission fees? Largely a thing of the past. They’ve turned investing from a formal, intimidating event into a background habit. You’re planting seeds, not trying to transplant a full-grown oak tree overnight.

Why Diversification is Your Financial Superpower

Think of your money like a group of explorers. If you send them all down the same path and that path gets blocked, you’re stuck. But if you send a few down different trails—some through stocks, some through bonds, maybe a couple into real estate or international markets—you dramatically increase the chances that at least some of them will find treasure.

Diversification is simply the art of not putting all your eggs in one basket. It smooths out the ride. When one investment is down, another might be up. For the everyday person, this isn’t about getting rich quick. It’s about building resilience. It’s about creating a financial buffer that lets you sleep better at night.

How Micro-Investing Platforms Make Diversification Effortless

This is where the magic happens. These apps are built with diversification as their core principle. They do the heavy lifting for you.

1. Fractional Shares: A Slice of the Pie

You don’t need $3,000 to buy a single share of a major tech company. With fractional shares, you can own a $5 piece of it. This is a game-changer. It means your $10 can be spread across 10 or 20 different companies or ETFs, instantly building a miniature, diversified portfolio from the get-go.

2. Pre-Built Portfolios and ETFs

Most platforms offer curated portfolios based on your goals and risk tolerance. You answer a few questions, and the algorithm suggests a mix of Exchange-Traded Funds (ETFs)—which are themselves baskets of hundreds of stocks or bonds. With one click, you’re invested in a globally diversified collection of assets. It’s instant diversification on a budget.

3. The “Set-and-Forget” Automation

The real power lies in consistency. Micro-investing apps excel at automation. You can set up recurring daily, weekly, or monthly deposits. Even better, many offer “round-up” features, where your card purchases are rounded up to the nearest dollar, and the difference is invested. It’s painless, almost invisible saving and investing.

Here’s a quick look at how these features stack up:

| Feature | Traditional Brokerage | Micro-Investing Platform |

| Minimum Investment | Often $500+ | As low as $1 or $5 |

| Fractional Shares | Limited availability | Core offering |

| Automated Investing | Possible, but complex | Simple, user-friendly core feature |

| Portfolio Diversification | Requires significant capital | Accessible with small amounts |

Building Your Diversified Streams: A Practical Approach

Okay, so how do you actually start building these income streams? It’s less about a giant leap and more about a series of small, deliberate steps.

First, define your “why.” Is this a long-term retirement fund? A medium-term goal like a down payment? Or a “rainy day” fund you can tap if needed? Your goal dictates your strategy.

Next, pick your vehicle. Most people start with a general investment account, but if retirement is the goal, look into an IRA option within your chosen app.

Then, just start. Honestly, the hardest part is starting. Here’s a simple, actionable plan:

- Choose one platform that resonates with you. Read a few reviews, check their fees, and just download it.

- Set up a recurring transfer for an amount you won’t miss. $5 a week. $20 a month. It doesn’t matter. The habit is the victory.

- Enable round-ups if available. This is found money. It feels like a financial hack.

- Select a diversified portfolio based on your risk questionnaire. Don’t overthink it. The “Moderately Aggressive” or “Conservative” option is fine to begin with.

- Leave it alone. Don’t check it daily. Let the compound interest—that magical force where your earnings start earning their own earnings—do its slow, steady work.

The Mindset Shift: From Spender to Owner

Perhaps the most profound change micro-investing brings isn’t just financial—it’s psychological. When you own a tiny piece of the companies you interact with every day—the coffee chain, the tech giant, the streaming service—your relationship with money shifts. You start thinking like an owner, not just a consumer.

That latte isn’t just a $5 expense; it’s also a potential source of a few cents in future dividend income if you’re invested. It reframes the entire conversation you have with your finances.

Of course, it’s not a fairy tale. The value of your investments will go down sometimes. That’s the nature of markets. Micro-investing is a long-term strategy, a marathon of small, consistent steps. It’s not a get-rich-quick scheme. But it is a get-resilient-slowly one.

In a world of economic uncertainty, building multiple, small streams of income through micro-investing is like weaving a financial safety net, one thread at a time. You might not notice each individual thread. But over time, they create something strong, something that can catch you if you fall—and maybe, just maybe, become the foundation for something much, much greater.