To invest is to put money into an investment with the hope of a return/profit in the near future. Simply put, to invest in means to buy or acquire an asset with the intention of making a profit from the sale or the gain of your investment that is the increase in the worth of the invested asset over a period of time, usually years. Many people have been attracted by the promise of large returns from their investments. However, not all investments are made with the best interests of the investor at heart.

For long term investors, there is no question that those who employ the services of investment professionals to help them evaluate and select the best stocks and the highest paying dividend shares are making a good decision. When they choose to invest through a brokerage account, they are being informed and choosing the right stocks and the right dividend shares. They have done their homework. They have educated themselves about the companies they wish to buy. The advice the professionals give the new investor has been studied, researched, and the most efficient way to manage funds has been determined. And the only thing left for the new investor to do is choose what funds to buy.

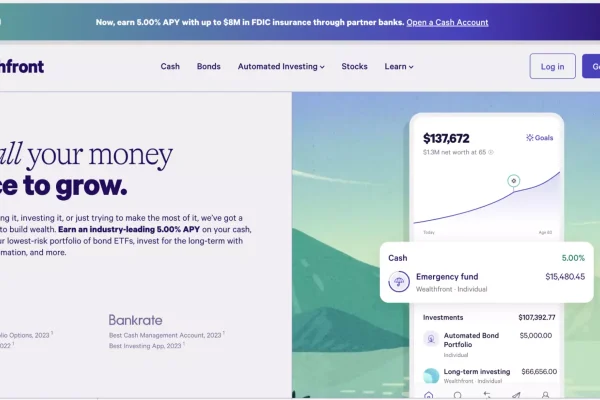

There are many different investment types for the investor. There are stock investments, mutual funds, bonds, foreign exchange, options, real estate and specialty stocks. All of these investment types have their own advantages and disadvantages, depending on the investor’s needs and goals. Each of these investment types also has a wide array of potential return and risk factors.

There are investment risks and rewards, also, associated with each of the investment types. The investor must carefully consider their own investment risks and their own reward objectives before investing. Diversification of one’s portfolio will help minimize risks and increase the investor’s overall investment return. For those investors who are not well-diversified, diversifying can be difficult, but it is a step in the right direction to increasing a healthy portfolio balance.

A good rule of thumb for an investor is to invest in the same category of securities that you have already purchased. For example, if you already own stocks in two particular categories, such as money market or U.S. bond, and are interested in investing in growth-oriented securities, you would be a good candidate to invest in growth-oriented securities. Growth-oriented investments tend to be the most stable, higher-yielding investments. They are typically comprised of both blue-chips and quality bonds. A good rule of thumb for diversification is to invest half of your total assets in stocks and the other half in growth oriented bonds. By diversifying, you are increasing the stability of your portfolio.

Some investors prefer to purchase mutual funds instead of individual stocks. Mutual funds typically consist of bonds, stocks, and other investment products. The advantage of mutual funds is that they offer a great platform for investors to increase their investments in their desired areas with ease. Because the fund manager is often an experienced financial expert, the wide array of investments is likely to ensure success. Many mutual funds offer special investments known as preferred investments, which allow investors to borrow money against their stocks or bonds for a small fee.